Taxes for Business Entities

Need a trusted tax expert with a personal touch? My goal is to help you understand your tax return and your overall financial picture, so you can confidently make informed decisions year-round.

Whether you’ve got a partnership, an S corporation, a C corporation, a trust or estate, or a nonprofit, I’m thrilled to offer you comprehensive tax services, hands-on support, audit protection, and future tax planning.

Ruby Plan

Preparation of your entity tax return

Secure communications and document storage on our encrypted client portal

Electronic signatures and filing (when available)

Starting at $750 (federal + state)

or $625 (federal only)

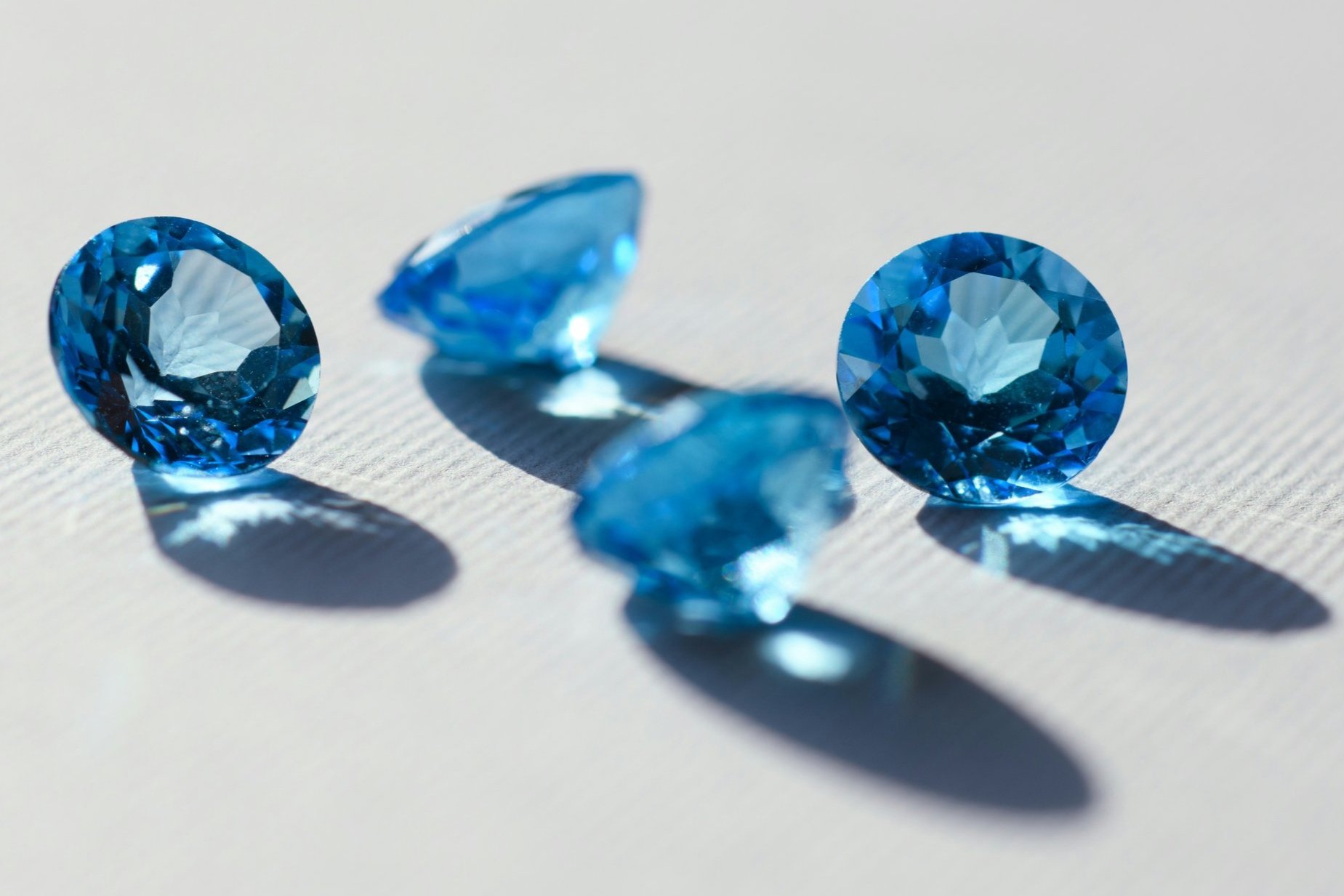

Sapphire Plan

Our most popular plan – everything in Ruby, plus:

Recorded video walkthrough of your tax returns

Reviewing and drafting a response to one letter from the IRS or a state tax agency per year

Two tax planning questions per year

End-of-year tax planning checkin

Starting at $950 (federal + state)

or $825 (federal only)

Emerald Plan

Our VIP experience – everything in Ruby, plus:

Live video call to walk through your tax return and answer questions

Reviewing and drafting a response to 2 letters from the IRS or a state tax agency per year

Quarterly checkins to answer tax questions and engage in tax planning

Starting at $1250 (federal + state)

or $1125 (federal only)

Additional fees may apply for the following scenarios:

EIN Application: $50

ITIN Application and document certification: $200

Additional state tax returns: $125 per state

Report of Foreign Financial Accounts (FBAR): $50 (up to 5 accounts, $10 per account thereafter)

Statement of Specified Foreign Financial Assets (Form 8938): $75

Cryptocurrency or other capital gains not reported on a form 1099-B: $100-$500 depending on volume

Issuing form 1099s to contractors: $15 per form

Printing and mailing: $10 handling charge plus actual postage costs

Streamlined Filing Procedures: click here for more information